Business rates: the basics

How business rates are calculated

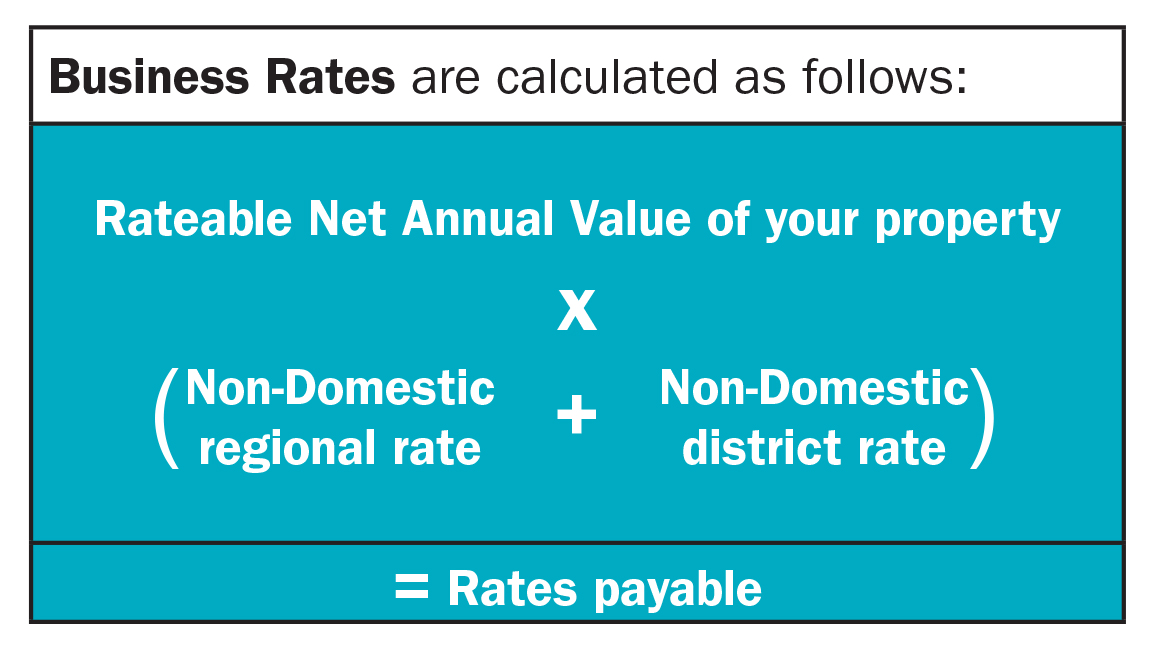

Your rate bill is made up of a number of parts including the regional rate, the district rate and Net Annual Value (NAV). Your rate bill is calculated by multiplying the NAV of your property by the non-domestic rate poundage (non-domestic regional rate + non-domestic district rate) for your council area for the relevant year (as shown below):

Regional and district rates

The regional rate is set annually by the Northern Ireland Executive and is applied to each district council area in Northern Ireland. The district rate is set annually by each district council in Northern Ireland.

Find the the 2024-25 non-domestic rate poundages for your council area.

Net Annual Value

Rates for non-domestic or business properties are assessed on their rental value, also known as the Net Annual Value (NAV). NAV is an assessment of the annual rental value that your property could reasonably be expected to be let for if it was on the open market. Each non-domestic property is valued in line with comparable properties in the vicinity.

The current valuation list for non-domestic properties came into operation on 1 April 2023 and is based on rental values as at 1 October 2021.

Find a property valuation for your business premises.

View your estimated rate bill

You can view an estimate of a full annual rate bill for the current rating year by inputting the address information using the LPS online valuation search.

Find a property valuation and view your estimated rate bill.

Queries on your business rates

If you have a query regarding business rates or are unsure of your outstanding bill you should contact Land & Property Services.

Reval 2026

The short video below explains the latest revaluation process, known as Reval 2026, which will create a new valuation list that will be used to calculate business rate bills from April 2026.